Price Increase for PV Modules in February: What to Expect in the Solar Market?

In the first quarter of 2022, the global solar market witnesses hike in PV modules cost. Although it appears to be the reaction of soaring commodity and logistic prices, it indicates a future point where the stable demand leads to a sustainable pricing model.

February 2022 observed a price hike in PV modules, contrary to December, when the prices were reduced. The cost of commodities and other elements like logistics has increased since last year. This situation is putting pressure on module manufacturers worldwide. Rising prices for solar PV modules have halted the industry's cost-cutting trend that was in place for a decade now, dampening the overall demand and, at the same time, disturbing the entire supply chain.

Module prices have risen to 25% since the last year. Several factors are the culprits for this price hike. Some of them could be resolved quickly, while others are more persistent. For everyone out there who is interested in the PV modules industry and wants to know what the future holds, here we have created a small price reference that will help you understand what is going on and what to expect.

Breaking Down the Cost

Upon a closer look at the PV modules material list, even with the higher prices, the profit margins remain slim. The price analysis of Rystad Energy revealed that the raw material prices across the board are driving up.

Some of the key components for PV modules and how they are acting up is below:

Polysilicon:

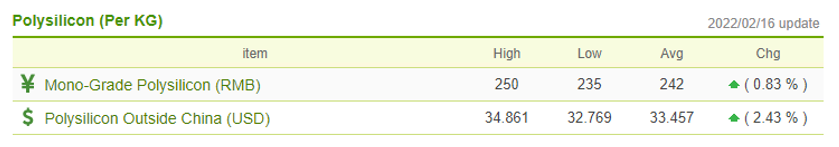

Polysilicon is the main driver for the continued price soaring, which costs almost triple to what it was in 2020. While many experts believe the prices for Polysilicon, along with the modules, will come down, the situation is still uncertain. Roughly the cost of Polysilicon sits at RMB 240 per kg, which is 338 percent higher than its all-time low.

One of the ironic reasons for this price increase is the lack of production capacity and increased demand. Due to the PV installation cap in China, no new polysilicon production came online in 2020. The PV market bounced back, rapidly than expected after the Covid-19 pandemic. This has spurred the demand and hence the price hike.

Wafers:

Wafer prices have climbed marginally as well. A week before the Chinese New Year, wafer makers successfully raised the prices of their products. After the holidays, when the industry bounced back to its full potential, high demand for wafers resulted in the continuous downstream supply of modules. While the demand kept amplifying. What should be considered is that the narrow line between market supply and demand in February, along with restricted polysilicon availability, might be going towards another price increase in wafers.

Cells:

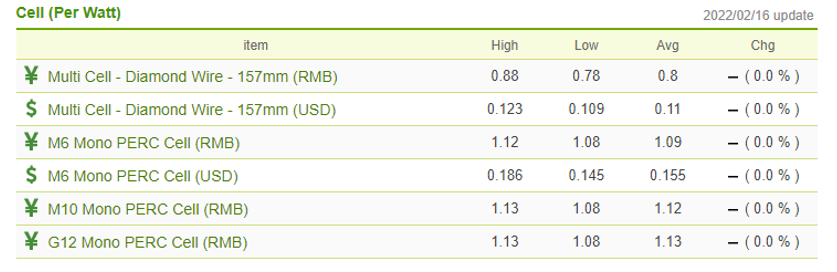

Cells are no alien to the recent overall price hike. Cells like M6, M10, and G12 are 1.12 RMB/W, 1.13 RMB/W, and 1.13 RMB/W, respectively. We expect an upward trend in cell prices. Given the supply and demand situation, an increase of 4% to 5% in prices won't be surprising.

Other Materials:

Prices for other industrial materials are also on a rising trajectory since 2021. What should be noticed is that the steel prices have gone up by 50%, copper by 60%, and aluminum by 80%. Although they are not the significant components in manufacturing the PV modules, the cost adds up for the final product.

Freight Rates:

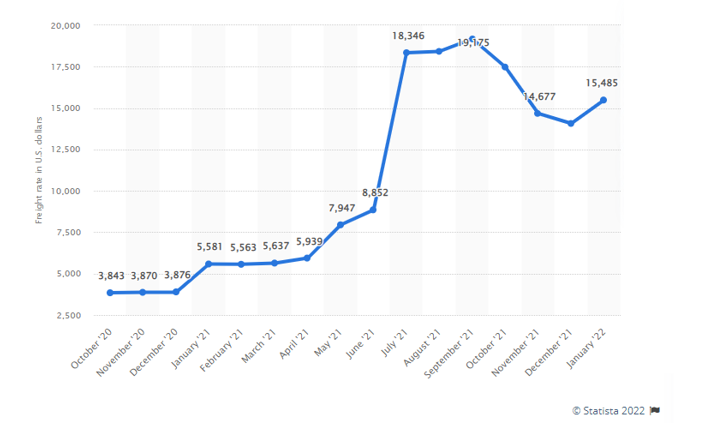

Freight rates are expected to stay high this year. Avery Vise, the vice president of trucking research at FTR Transportation Intelligence, said that there would be no decrease in freight prices in the first quarter of 2022 and most probably till the mid of the year.

Statista reveals that the global container freight rates from China to North America or Eastern Asia are approximately 15,500 U.S. dollars for shipping a 40' container.

Overall Price Increase for PV Modules

The imbalances in China's supply chain and consumption control policies are the main reason behind the incessant price rise for sustainable energy modules. Given that the raw material cost is rising, naturally, the prices for PV modules are expected to grow in February as well.

Manufacturing hardly makes up 30% of the cost while the remaining 70% of cost is from the raw material. These price developments are the bitter pill for module manufacturers as they were making impressive progress to maintain or even reduce the cost and eliminate carbon imprints on the environment.

Conclusion:

To sum it up, this situation has implications for the equipment manufacturers. Higher prices in February 2022 have reversed the trend for rapid adaptation of renewable energy. While the uncertainty remains as to how far the prices for commodities and raw materials will go, it will have a long-lasting impact on the profitability of this industry. Despite all the challenges, the global intent to go green continues, and in the end, it will depend on the demands of end-users.

Categories

Latest Posts

-

01.07.2025

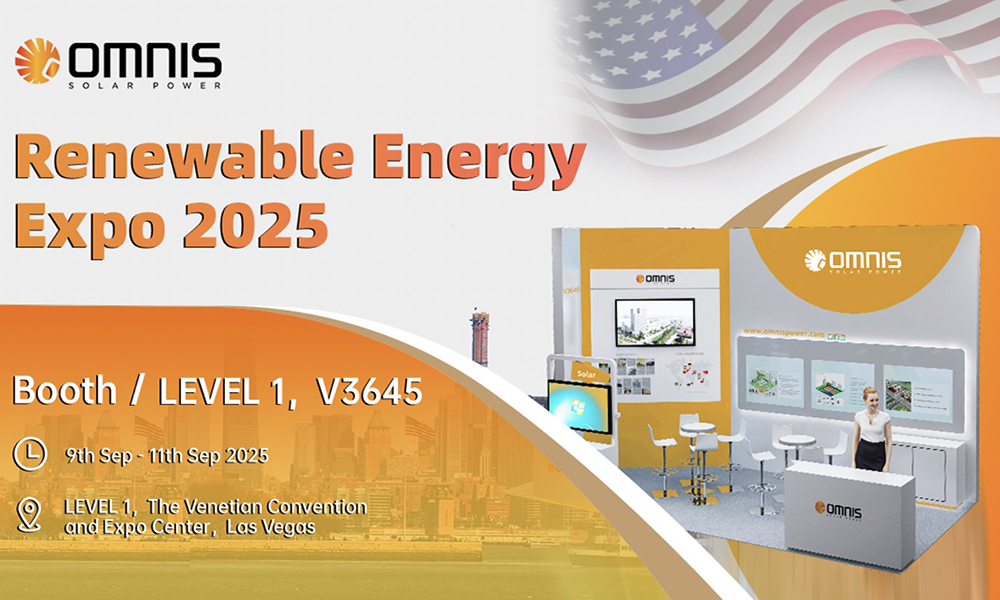

01.07.2025Renewable Energy Exp0 2025

-

22.08.2023

22.08.2023New Branding , New Journey

-

20.10.2022

20.10.2022Omnis Solar Power Obtains Italian Class 1 Fire Certification

-

26.07.2022

26.07.2022JOIN Omnis Solar Power AT INTERSOLAR SOUTH AMERICA - 2022!